Businesses Again Many Hospitals Have Taken Steps to Create a Business Continuity Plan

MAR.14, 2017

Hospital Business Plan Sample

Do you want to start a Hospital business plan?

Starting a business can be very hard and a big responsibility. And starting one that benefits humanity can be an even greater responsibility. However, if you follow the correct steps and stay persistent, it can be very rewarding. Establishing a business like a hospital needs to be very thoroughly planned.

The best way to plan a business and all of its details are to write a business plan for hospital. Adding all the right details and values of your business will attract investors to business plan and this will help you is getting your business set up. If you want to learn how to write a hospital business plan, you should go through as many samples as you can.

Plans like nursing home business plan can be a great resource in understanding everything you need to plan for in your hospital business. In this business plan, we will be providing all the details for starting a hospital called Mercy Ltd. You can follow along with this sample to develop a plan for your business.

Start your Business Plan Now

Start My Business Plan

Executive Summary

2.1 Business Summary

Mercy Ltd will be a private healthcare setup owned and started by Gillian Hail. It will provide state-of-the-art services to all its patients. Additionally, it will also run a free clinic and find services for those who don't have enough funds to get treatment.

2.2 About the Management

As a hospital business requires the utmost attention to detail to run well, a business plan is needed ahead of time. It is similar to a business plan for a wellness center in that regard. To make the management of Mercy Ltd smooth, a hospital business development plan was needed. Therefore, we prepared this sample.

If you want to develop an executive summary hospital business plan for your business, you can consult a healthcare business plan template. Otherwise, to write the business plan, you can also hire experts and guide them along.

2.3 Customers of Mercy Ltd

Considering that Mercy Ltd is a healthcare center, its customers will primarily be patients seeking treatment or help with funding for treatment. They will belong to all domains and lifestyles. The primary customers will include:

- OPD Patients

- Emergency Care Patients

- Chronic Patients

- Treatment Fund Patients

2.4 Business Target

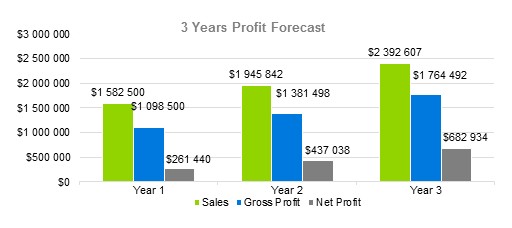

The target of Mercy Ltd is to become a trustworthy healthcare center where people can come to get immediate treatment whenever they need it. It will also be a long-term target to expand the business. The financial targets we want to meet within the first three years of start are mentioned below in this hospital business plan pdf.

Franchise Business Plan

Helps the franchisee get business case approval from the franchisor

Company Summary

3.1 Hospital Ownership

The hospital will be owned and managed primarily by Gillian Hail. She completed her MD five years ago after which she served as a head neurosurgeon in a renowned hospital in Baltimore. She then assumed the position of a consultant to start her healthcare setup.

3.2 History

Gillian always wanted to make a difference and help people due to which she became a doctor. However, after working in a hospital for so many years, she realized that there was a greater need for a healthcare setup that could deal with patients faster. Therefore, she decided that she would open Mercy Ltd to provide quick care to simple patients and would also gain funding for people who were struck by an ailment or accident, but their insurance couldn't cover for them.

3.3 How will Mercy be Established

Step1: Plan Everything

The first step before establishing any business, no matter what the domain or scope, is thorough planning. You will need to map out everything required to start the business in a business plan for starting a hospital. Additionally, you will also need to develop a business plan for hospital expansion if you have any plans to extend the business in the future. The process won't stop here because at some point, you will also be developing a business continuity plan hospital. However, in the begging, it is necessary to give full attention to get the business off the ground.

Step2: Get Funding

One of the main reasons to develop a startup hospital business plan is to get funds. As Mercy Ltd had the aim to help treat those who couldn't afford usual hospital charges, therefore, Gillian paid special attention to this hospital business plan sample pdf to attract investors.

Step3: Find a Location

To house the healthcare setup, Gillian chose a building in Baltimore. The lower two floors will be for the hospital whereas the top floor will be for management and to house on-call doctors.

Step4: Developing a Brand

It is essential to make your business as human as possible so that your customers can relate to it. Therefore, Gillian not only focused on her business model to help people but also describe it in a way that is understandable to its customers.

Step5: Promote and Market

To get the word out about her unique business model, Gillian established a partnership with as many local and big hospitals as she could so they could refer patients to Mercy Ltd for simple and free treatments as well as funding.

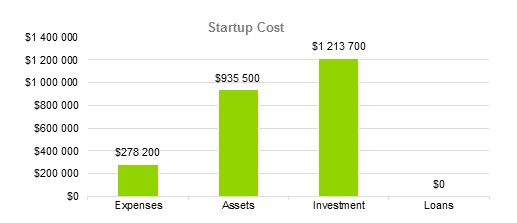

| Start-up Expenses | |

| Legal | $152,400 |

| Consultants | $0 |

| Insurance | $25,100 |

| Rent | $35,100 |

| Research and Development | $10,000 |

| Expensed Equipment | $52,200 |

| Signs | $3,400 |

| TOTAL START-UP EXPENSES | $278,200 |

| Start-up Assets | $251,400 |

| Cash Required | $181,000 |

| Start-up Inventory | $35,100 |

| Other Current Assets | $251,000 |

| Long-term Assets | $217,000 |

| TOTAL ASSETS | $935,500 |

| Total Requirements | $1,213,700 |

| START-UP FUNDING | |

| Start-up Expenses to Fund | $278,200 |

| Start-up Assets to Fund | $935,500 |

| TOTAL FUNDING REQUIRED | $1,213,700 |

| Assets | |

| Non-cash Assets from Start-up | $1,222,000 |

| Cash Requirements from Start-up | $115,000 |

| Additional Cash Raised | $50,000 |

| Cash Balance on Starting Date | $35,000 |

| TOTAL ASSETS | $1,422,000 |

| Liabilities and Capital | |

| Liabilities | $18,200 |

| Current Borrowing | $0 |

| Long-term Liabilities | $0 |

| Accounts Payable (Outstanding Bills) | $61,500 |

| Other Current Liabilities (interest-free) | $0 |

| TOTAL LIABILITIES | $79,700 |

| Capital | |

| Planned Investment | $1,213,700 |

| Investor 1 | $0 |

| Investor 2 | $0 |

| Other | $0 |

| Additional Investment Requirement | $0 |

| TOTAL PLANNED INVESTMENT | $1,213,700 |

| Loss at Start-up (Start-up Expenses) | $128,600 |

| TOTAL CAPITAL | $1,342,300 |

| TOTAL CAPITAL AND LIABILITIES | $1,422,000 |

| Total Funding | $1,213,700 |

Any questions? Get in Touch!

Services

To write a business plan for a hospital, one needs to be clear about the type of business they want to establish. And this is true for every business plan, may it be a reiki practice business plan or a private hospital business plan pdf.

To develop a hospital business plan sample, you will need to know the services you want to provide to your customers as they will form the basis of your setup. Here, we have provided a hospital business plan template that you can follow when writing about the services of your business. You can also look at any other hospital business plan example for reference.

- OPD

We will provide all the basic outpatient facilities including diagnosis, testing, and providing immediate treatment to patients. This will apply to patients with simple ailments like infection, common cold, fever or pain, etc.

- Emergency Services

Mercy Ltd will also provide emergency services to patients who have been involved in an accident and need immediate care for stabilization. We shall also provide ambulances to transport these patients to bigger hospitals for complete and thorough treatment and recovery.

- Regular Treatment and Therapy

For the patients who have chronic ailments or pain and need regular care and treatment, we will offer therapy sessions and a complete care package that they can use regularly instead of needing to go to other hospitals.

- Funding

One of our core services will be to provide treatment funding to deserving patients. The cases and situations of the patients will be thoroughly vetted to ensure that there is no problem.

Marketing Analysis of Hospital Company

excellent work

excellent work, competent advice.

Alex is very friendly, great communication.

100% I recommend CGS capital.

Thank you so much for your hard work!

It can be very tricky to gain success as a new business. You need solid hospital strategic goals to ensure that your business is taken care of from the start. A good business owner needs to do a lot of research into hospital business development strategies before starting a business in this domain.

A good business plan covers all details regarding the business, including things like hospital planning team and business model hospital. This information helps in showing the objectives of hospital planning to the investors. And all of this can only be achieved if you have a strong understanding of your target market. This includes your customers as well as your competitors.

In this hospital marketing plan template, we have outlined all the marketing strategies that would be employed by Gillian to ensure the success of her business. You can follow this hospital business plan sample or something related like a massage therapy center business plan for more guidance.

5.1 Market Trends

According to PolicyAdvice, the healthcare industry is one of the fastest-growing industries of the US and the trend is expected to continue as the US spends almost twice as compared to other countries on healthcare. Right now, the market share of the healthcare industry in the US is at almost $10 Billion and it is expected to rise. Therefore, healthcare is one of the best sectors to start a business in.

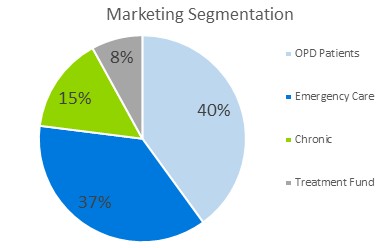

5.2 Marketing Segmentation

The target customer groups of Mercy Ltd will be:

Business Plan for Investors

5.2.1 OPD Patients

Our primary services are centered around situations where patients only need immediate care and have straightforward illnesses. Therefore, these patients with simple ailments will be the key customers of Mercy Ltd as they will utilize our services in almost half the time as any other hospital.

5.2.2 Emergency Care Patients

Our second target customers will be the people who need immediate care after an accident such as a fall or a crash. Our main responsibility will be to stabilize these patients so that they can be safely transferred to required hospitals for full care.

5.2.3 Chronic Patients

We will also get business from people with chronic ailments who only need to go to hospitals for regular check-ups but find it hard to. We will provide them with in-house regular check-ups and treatment facilities so that they don't have to spend too much time or energy on commute.

5.2.4 Treatment Fund Patients

Lastly, one of our primary services is funding, we will also take up cases of patients who need money for treatment but because of one reason or another are not able to. The funding for these patients will come from our investors as well as 8% of our profits.

| Market Analysis | |||||||

| Potential Customers | Growth | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | CAGR |

| OPD Patients | 40% | 56,100 | 67,320 | 80,784 | 96,941 | 116,329 | 10.00% |

| Emergency Care | 37% | 44,100 | 52,920 | 63,504 | 76,205 | 91,446 | 10.00% |

| Chronic | 15% | 26,100 | 31,320 | 37,584 | 45,101 | 54,121 | 10.00% |

| Treatment Fund | 8% | 20,100 | 24,120 | 28,944 | 34,733 | 41,679 | 11.00% |

| Total | 100% | 146,400 | 175,680 | 210,816 | 252,979 | 303,575 | 10% |

5.3 Business Target

- To become the best immediate care hospital in Baltimore

- To expand our services across the US in form of multiple small centers

- To earn a net profit margin of $15k/month by the end of our second year

- To be the first healthcare service that helps patients with funding

5.4 Product Pricing

Our prices will be similar to that of our competitors. However, we will provide twice the speed of regular hospitals that are usually too burdened.

Marketing Strategy

To become successful in a market as tough as healthcare, you will need to work on your hospital business strategy. This strategy will be reflected in your business plan hospital. You can also look at strategic plan example hospital for reference.

Understanding all aspects of planning in hospital will help you gain a better view of the market and help your business succeed. So, whether it is a business plan for healthcare setup or a business plan for occupational therapy, you should look into the market for a stronger plan.

Any questions? Get in Touch

6.1 Competitive Analysis

- We have excellent and unique services

- Our customers can get help in almost half the time as regular hospitals for basic healthcare

- We provide treatment funding to people who cannot afford it

- Our customers can avail of our ambulance and emergency services through a quick phone call as well

6.2 Sales Strategy

- We will get the word out through partnerships with hospitals

- We will use social media for a wider reach

- We will offer discounts to deserving people

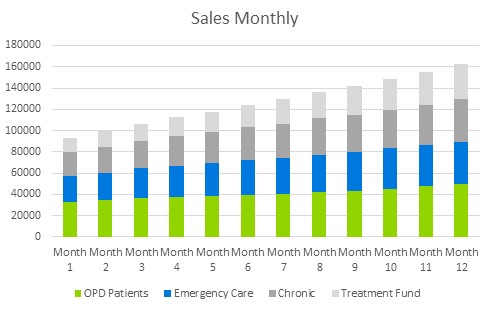

6.3 Sales Monthly

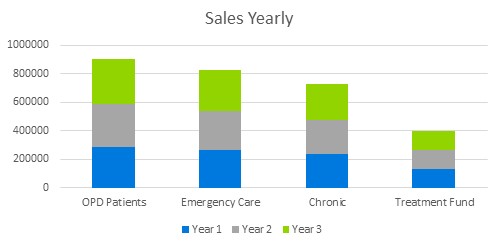

6.4 Sales Yearly

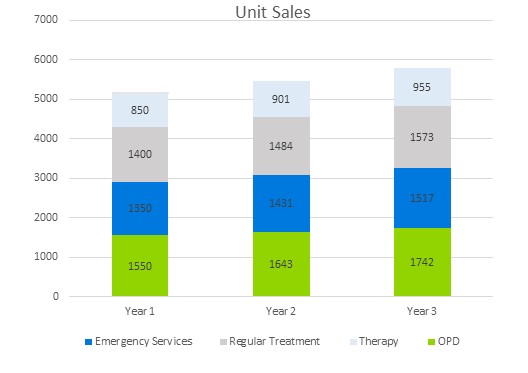

6.5 Sales Forecast

| Sales Forecast | |||

| Unit Sales | Year 1 | Year 2 | Year 3 |

| OPD | 1,550 | 1,643 | 1,742 |

| Emergency Services | 1,350 | 1,431 | 1,517 |

| Regular Treatment | 1,400 | 1,484 | 1,573 |

| Therapy | 850 | 901 | 955 |

| TOTAL UNIT SALES | 5,150 | 5,459 | 5,787 |

| Unit Prices | Year 1 | Year 2 | Year 3 |

| OPD | $350.00 | $406.00 | $470.96 |

| Emergency Services | $250.00 | $290.00 | $336.40 |

| Regular Treatment | $350.00 | $406.00 | $470.96 |

| Therapy | $250.00 | $290.00 | $336.40 |

| Sales | |||

| OPD | $542,500.00 | $667,058.00 | $820,214.52 |

| Emergency Services | $337,500.00 | $414,990.00 | $510,271.70 |

| Regular Treatment | $490,000.00 | $602,504.00 | $740,838.92 |

| Therapy | $212,500.00 | $261,290.00 | $321,282.18 |

| TOTAL SALES | $1,582,500.00 | $1,945,842.00 | $2,392,607.32 |

| Direct Unit Costs | Year 1 | Year 2 | Year 3 |

| OPD | $100.00 | $110.00 | $115.50 |

| Emergency Services | $100.00 | $110.00 | $115.50 |

| Regular Treatment | $90.00 | $99.00 | $103.95 |

| Therapy | $80.00 | $88.00 | $92.40 |

| Direct Cost of Sales | |||

| OPD | $155,000.00 | $180,730.00 | $201,152.49 |

| Emergency Services | $135,000.00 | $157,410.00 | $175,197.33 |

| Regular Treatment | $126,000.00 | $146,916.00 | $163,517.51 |

| Therapy | $68,000.00 | $79,288.00 | $88,247.54 |

| Subtotal Direct Cost of Sales | $484,000.00 | $564,344.00 | $628,114.87 |

Personnel plan

A good business plan for hospitals will reflect all the aspects of the setup thoroughly for well-management. This even includes the workforce and employees that make it possible to run a setup. In this hospital business plan template, we will be looking at the employee and hiring structure of Mercy Ltd.

7.1 Company Staff

- 1 Co-Manager to help in overall operations

- 8 Certified Doctors

- 4 Nurses

- 3 General Cleaners

- 1 Technician to upkeep the machinery

- 1 HR Executive

- 2 Ambulance Drivers

- 2 Receptionists

7.2 Average Salary of Employees

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Manager | $30,000 | $33,000 | $36,300 |

| Certified Doctors | $245,000 | $269,500 | $296,450 |

| Nurses | $125,000 | $137,500 | $151,250 |

| Cleaners | $62,500 | $68,750 | $75,625 |

| Technician | $22,500 | $24,750 | $27,225 |

| HR Eecutive | $22,500 | $24,750 | $27,225 |

| Ambulance Drivers | $42,500 | $46,750 | $51,425 |

| Receptionists | $42,500 | $46,750 | $51,425 |

| Total Salaries | $592,500 | $651,750 | $716,925 |

Financial Plan

The success of a business and its smooth running depends on a lot more than hospital business plans. You need to ensure that you have enough finances to support your operations and range of services. This is where hospital financial planning comes in.

To ensure that everything is running with balance and you're not going into a loss, you will need to keep proper track of your finances. One way to deal with the overwhelming load of financial management is to make a financial plan. This can act as a guide for you to follow along as the business progresses.

Here, we are detailing the financial plan for Mercy Inc. You can also look at similar plans such as a non-medical home care business plan to get a hint.

8.1 Important Assumptions

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 8.12% | 8.20% | 8.26% |

| Long-term Interest Rate | 8.40% | 8.44% | 8.47% |

| Tax Rate | 24.03% | 24.21% | 24.60% |

| Other | 0 | 0 | 0 |

Any questions? Get in Touch

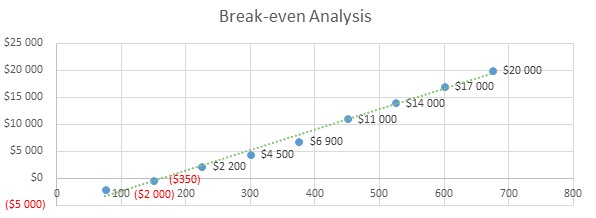

8.2 Break-even Analysis

| Break-Even Analysis | |

| Monthly Units Break-even | 5340 |

| Monthly Revenue Break-even | $132,500 |

| Assumptions: | |

| Average Per-Unit Revenue | $231.00 |

| Average Per-Unit Variable Cost | $0.62 |

| Estimated Monthly Fixed Cost | $163,800 |

8.3 Projected Profit and Loss

| Pro Forma Profit And Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $1,582,500 | $1,945,842 | $2,392,607 |

| Direct Cost of Sales | $484,000 | $564,344 | $628,115 |

| Other | $0 | $0 | $0 |

| TOTAL COST OF SALES | $484,000 | $564,344 | $628,115 |

| Gross Margin | $1,098,500 | $1,381,498 | $1,764,492 |

| Gross Margin % | 69.42% | 71.00% | 73.75% |

| Expenses | |||

| Payroll | $592,500 | $651,750 | $716,925 |

| Sales and Marketing and Other Expenses | $145,000 | $148,000 | $156,000 |

| Depreciation | $2,300 | $2,350 | $2,500 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $2,900 | $3,000 | $3,100 |

| Insurance | $2,100 | $2,100 | $2,100 |

| Rent | $2,900 | $3,000 | $3,200 |

| Payroll Taxes | $24,000 | $25,000 | $27,000 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $771,700 | $835,200 | $910,825 |

| Profit Before Interest and Taxes | $326,800 | $546,298 | $853,667 |

| EBITDA | $326,800 | $546,298 | $853,667 |

| Interest Expense | $0 | $0 | $0 |

| Taxes Incurred | $65,360 | $109,260 | $170,733 |

| Net Profit | $261,440 | $437,038 | $682,934 |

| Net Profit/Sales | 16.52% | 22.46% | 28.54% |

8.3.1 Profit Monthly

8.3.2 Profit Yearly

8.3.3 Gross Margin Monthly

8.3.4 Gross Margin Yearly

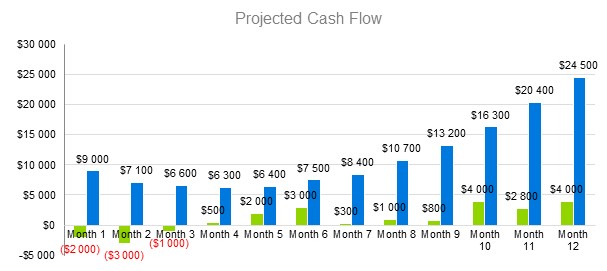

8.4 Projected Cash Flow

| Pro Forma Cash Flow | |||

| Cash Received | Year 1 | Year 2 | Year 3 |

| Cash from Operations | |||

| Cash Sales | $51,000 | $55,080 | $59,486 |

| Cash from Receivables | $22,000 | $23,760 | $25,661 |

| SUBTOTAL CASH FROM OPERATIONS | $73,000 | $79,570 | $85,936 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| SUBTOTAL CASH RECEIVED | $74,000 | $79,000 | $85,000 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $42,000 | $42,000 | $45,000 |

| Bill Payments | $27,000 | $28,000 | $31,000 |

| SUBTOTAL SPENT ON OPERATIONS | $69,000 | $70,000 | $76,000 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| SUBTOTAL CASH SPENT | $69,000 | $74,520 | $80,482 |

| Net Cash Flow | $21,000 | $23,000 | $25,000 |

| Cash Balance | $27,000 | $30,000 | $33,000 |

8.5 Projected Balance Sheet

| Pro Forma Balance Sheet | |||

| Assets | Year 1 | Year 2 | Year 3 |

| Current Assets | |||

| Cash | $275,000 | $308,000 | $338,800 |

| Accounts Receivable | $24,000 | $26,880 | $30,213 |

| Inventory | $4,300 | $4,816 | $4,900 |

| Other Current Assets | $1,000 | $1,000 | $1,000 |

| TOTAL CURRENT ASSETS | $282,000 | $315,840 | $355,004 |

| Long-term Assets | |||

| Long-term Assets | $10,000 | $10,000 | $10,000 |

| Accumulated Depreciation | $19,400 | $21,728 | $24,444 |

| TOTAL LONG-TERM ASSETS | $24,400 | $27,328 | $30,744 |

| TOTAL ASSETS | $294,000 | $329,280 | $370,440 |

| Liabilities and Capital | Year 4 | Year 5 | Year 6 |

| Current Liabilities | |||

| Accounts Payable | $18,700 | $20,944 | $23,541 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| SUBTOTAL CURRENT LIABILITIES | $19,000 | $21,280 | $23,919 |

| Long-term Liabilities | $0 | $0 | $0 |

| TOTAL LIABILITIES | $15,000 | $16,800 | $18,883 |

| Paid-in Capital | $30,000 | $30,000 | $31,000 |

| Retained Earnings | $53,000 | $57,770 | $63,547 |

| Earnings | $193,400 | $210,806 | $231,887 |

| TOTAL CAPITAL | $285,000 | $310,650 | $341,715 |

| TOTAL LIABILITIES AND CAPITAL | $300,000 | $329,280 | $370,440 |

| Net Worth | $293,400 | $319,806 | $351,787 |

8.6 Business Ratios

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | INDUSTRY PROFILE | |

| Sales Growth | 7.25% | 8.03% | 8.90% | 3.00% |

| Percent of Total Assets | ||||

| Accounts Receivable | 9.21% | 10.20% | 11.31% | 9.80% |

| Inventory | 5.39% | 5.97% | 6.62% | 9.90% |

| Other Current Assets | 2.11% | 2.34% | 2.59% | 2.40% |

| Total Current Assets | 149.80% | 151.00% | 152.00% | 158.00% |

| Long-term Assets | 11.55% | 11.60% | 11.64% | 12.00% |

| TOTAL ASSETS | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 4.90% | 4.94% | 4.98% | 4.34% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 0.00% |

| Total Liabilities | 7.59% | 7.65% | 7.72% | 7.38% |

| NET WORTH | 100.45% | 101.25% | 102.19% | 110.00% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 94.60% | 97.15% | 99.87% | 99.00% |

| Selling, General & Administrative Expenses | 93.56% | 96.09% | 98.78% | 97.80% |

| Advertising Expenses | 1.52% | 1.56% | 1.60% | 1.40% |

| Profit Before Interest and Taxes | 41.50% | 42.62% | 43.81% | 33.90% |

| Main Ratios | ||||

| Current | 34 | 35 | 36 | 32 |

| Quick | 33 | 33.8 | 34.645 | 33 |

| Total Debt to Total Assets | 0.18% | 0.18% | 0.17% | 0.40% |

| Pre-tax Return on Net Worth | 74.08% | 74.89% | 75.00% | 75.00% |

| Pre-tax Return on Assets | 96.30% | 101.12% | 106.17% | 111.30% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 33.56% | 34.60% | 35.67% | N.A. |

| Return on Equity | 55.80% | 57.53% | 59.31% | N.A. |

| Activity Ratios | ||||

| Accounts Receivable Turnover | 7.7 | 7.8 | 7.8 | N.A. |

| Collection Days | 100 | 100 | 100 | N.A. |

| Inventory Turnover | 32.4 | 34.02 | 35 | N.A. |

| Accounts Payable Turnover | 15.6 | 16 | 16.3 | N.A. |

| Payment Days | 27 | 27 | 27 | N.A. |

| Total Asset Turnover | 2.5 | 2.5 | 2.6 | N.A. |

| Debt Ratios | ||||

| Debt to Net Worth | -0.04 | -0.03 | -0.04 | N.A. |

| Current Liab. to Liab. | 1 | 1 | 1 | N.A. |

| Liquidity Ratios | ||||

| Net Working Capital | $244,000 | $257,664 | $272,093 | N.A. |

| Interest Coverage | 0 | 0 | 0 | N.A. |

| Additional Ratios | ||||

| Assets to Sales | 0.85 | 0.87 | 0.89 | N.A. |

| Current Debt/Total Assets | 1% | 0% | 0% | N.A. |

| Acid Test | 29 | 29.12 | 29.16 | N.A. |

| Sales/Net Worth | 2.1 | 2.2 | 2.2 | N.A. |

| Dividend Payout | 0 | 0 | 0 | N.A. |

FAQ

1. How do you start a hospital business?

You can start healthcare set up by reviewing the strategic management in hospitals. This will inform you if you can manage the plethora of responsibilities that come with every healthcare business.

2. What is hospital business plan?

A business plan for hospitals is a document that is developed before starting a venture. It is done to ensure that you can take the right steps to make your business a success. It helps with planning, management, and problem resolution among other things.

3. What are the 4 types of hospitals?

The basic 4 types of hospitals in the US according to JamaNetwork are:

- Community Hospitals

- Federal Govt Hospitals

- Non-Federal Psychiatric Care

- Non-Federal Long-term care

The business plan hospital provided here is for a private community hospital.

4. How do I write a hospital proposal?

You can write a hospital proposal by going through the private hospital business plan provided above and following all the tips mentioned.

Download Hospital Business Plan Sample in pdf

Illustrative business plan samples

OGSCapital's team has assisted thousands of entrepreneurs with top-rate business plan development, consultancy and analysis. They've helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

Any questions? Get in Touch!

We have been

mentioned in the press:

Source: https://www.ogscapital.com/article/hospital-business-plan/

0 Response to "Businesses Again Many Hospitals Have Taken Steps to Create a Business Continuity Plan"

Enregistrer un commentaire